Roads to Recovery

What We’re Seeing

“Here’s the key to understanding risk: it’s largely a matter of opinion.” – Howard Marks

Fall is here, bringing along cooler weather and new beginnings. Despite the chill, our economy seems to be holding its warmth, confounding the naysayers. Post-COVID, the world economy has been akin to someone recovering from a significant injury. Although it's been a tough hit, we're gradually getting back on our feet, even after a couple of years. It’s a reminder that recovery from any setback, economic or otherwise, is possible with time and effort.

This resilience shows an economy that's standing firm. In challenging times, it’s often entrepreneurs and business owners, as well as those who work alongside them in their organizations, who continue to demonstrate remarkable adaptability, positioning themselves to not only survive the short term but thrive in the long term. Such creativity is not to be underestimated. It has been a cornerstone in the creation of jobs, profits, and generational wealth. On the flip side, there have been responses, like the concept of 'Austerity' during the Financial Crisis, that were met with less success.

So, we’re left with two powerful tools: grit and creativity - grit to survive tough times and creativity to innovate. Against this backdrop of a resilient job market and a surprisingly stable housing sector, the ‘value’ created by companies and entrepreneurs is on full display in the economy today. While other strategies have stumbled, with creativity and adaptability, recovery is more than just optimism.

5 Major Takeaways

- Oil: Recent months have shown an uptick in oil prices, partially attributed to seasonal trends but significantly influenced by OPEC+'s strategic production cuts. Oil prices are an important input into many factors in different parts of the economy and are sometimes a leading indicator of inflation. Despite that, gas prices have remained relatively flat.

- The Fed’s “Higher for Longer” Pause: In its September meeting, the Federal Reserve opted to keep the policy rate unchanged, reflecting a cautious approach toward the economic outlook. This move aligns with their "data-driven decision" stance, appreciating the ongoing trend of disinflation. A "higher for longer" narrative emerged, indicating the Fed’s intention to maintain elevated rates until they're confident about reining in inflation close to their 2% target. Given that interest rates are at their highest in a decade, ongoing rates at this level might be a tough pill to swallow.

- Housing Market Strength: Home prices are holding firm despite higher rates, thanks to a blend of factors. For instance, 61% of home mortgages are below 4% [Link], discouraging many from altering their housing situation. This scenario contributes to a tighter housing market [Link], although recent home construction spikes [Link] hint at some recovery. The housing market is such an integral part of the US economy that as long as it remains strong, the economy may stay strong right along with it.

- Strikes and Shutdowns: Headlines have spotlighted labor strikes at UAW-affiliated Ford and GM plants, the now-resolved WGA strike, and SAG-AFTRA, as well as the potential for government shutdowns. While markets often overlook these disruptions, a closer look reveals underlying causes like wage growth not keeping pace with inflation. Auto companies and major studios are caught up in the transition to electric vehicles or streaming, often at a steep loss. However, as we’ve mentioned, growth and recovery come from being able to adapt to changing opportunities.

- Personal Inflation: So, what are we to do when we are constantly bombarded by headlines worrying about the state of the economy and the inflation boogeyman? Inflation isn't a one-size-fits-all experience. Whether you're locked into a 3% 30-year fixed mortgage or renting in high-cost areas, whether you cook at home or dine out—everyone's inflation experience is unique. Be mindful of your personal inflation rate and resist the urge to keep up with the “Jones’.”

One Big Number

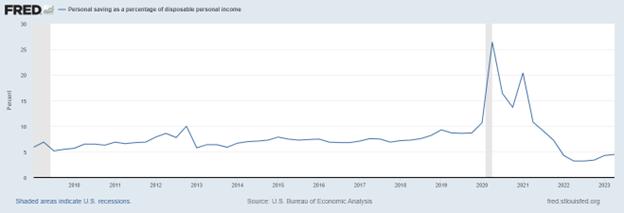

4.5%1

That's the current rate of personal savings as a percentage of disposable income. This marks a decline from the pre-Covid figure of 9.6% at the outset of 2019 and a recovery from the trough of 3.6% in the second quarter of 2022.

And One Big Chart

Displayed above is the trajectory of the personal savings rate as a fraction of disposable income since the Great Financial Crisis. So, what does this mean? Essentially, it's the percentage of what individuals manage to save after obligatory deductions like income taxes, social security, and Medicare contributions. Given the uncertainty surrounding pensions and the limitations of Social Security, personal savings have become increasingly vital for individual financial stability. The chart shows how, outside of some extraordinary measures during COVID, the rate has realigned with its decade-long trend. Although there's more ground to cover on the recovery front, the current trend signifies a promising direction.

As always, if you have questions or want to discuss more of what you read here, reach out to your financial advisor. We’ll be happy to chat.

1 Source: Federal Reserve Economic Data (FRED), Federal Reserve Bank of St. Louis; Personal Saving Rate [PSAVERT]. https://fred.stlouisfed.org/series/PSAVERT.

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Brian Frederick and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Diversification and asset allocation does not ensure a profit or protect against a loss. Holding investments for the long term does not ensure a profitable outcome.