The Financial Tightrope

“The thing that most affects the stock market is everything.” James Palysted Wood, 1966

The market can be a tightrope sometimes. A constant balancing act of varying forces. All these forces combine into a melting pot called "the market," where we find an equilibrium known as "price."

In today's ever-changing world, balance isn’t easy to find. Central banks, investors, and the global economy struggle to find stability amid market fluctuations, inflation, and labor conditions. As the economic winds blow, the rope shakes, and conditions try to throw us off. When walking a tightrope, one of the first things you’re taught is to make tiny adjustments while focusing on a long-term goal, maintain your footing, and walk confidently, knowing you’ll get there. Trust your process, and balance will find you amidst uncertainty. That’s the mindset we like to take here at Mainspring.

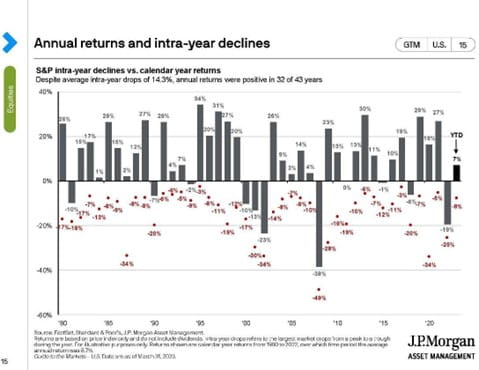

A lot is going on right now, and we go through some of the key points below: inflation and rate hikes, labor market stability, and constant prognostications of recession. But we also try to find the signal through the noise, and remember, over the last 43 years, the market has ended the year positively 74% of the time.

If you have questions or concerns, don't hesitate to reach out to your advisor. We're always here to be a guide, helping you maintain balance and focus as you navigate the complex financial landscape.

5 Major Takeaways:

- Balancing act: Central banks, investors, and the global economy are all striving to find equilibrium, whether it's maintaining financial stability, focusing on quality stocks, or addressing inflation and labor market conditions.

- Inflation and rate hikes: Elevated inflation concerns have led to interest rate hikes by the Federal Reserve, ECB, and BOE, as they strive to achieve some sense of balance in the economy, potentially resulting in tighter financial conditions and recession in the near to mid-term.

- Labor market resilience: Despite tightening monetary policy, labor markets remain strong, with high job openings and low unemployment rates. While we are starting to see some recent cooling, more is expected as policy continues to tighten.

- Investing in a climate of fear: Fear is a powerful driver in the investment world, causing loss aversion and scarcity Warren Buffett's advice to "be fearful when others are greedy, and greedy when others are fearful" can help us navigate this emotional landscape providing a signal in the noise with which to balance our, at times, tumultuous mind.

- Trust and process: A disciplined investment process emphasizing diversification, cost- effectiveness, and tax efficiency can help build a solid foundation. It’s our trust and confidence in that process that leads to long-term investment success. By having a core to fall back on, we’re always able to center ourselves amidst changing circumstances.

One Big Number and One Big Chart

74%

This chart shows the biggest loss for each year in red and what the market finished the year at in grey. There has never been a year where the stock market was positive the entire year. The average intra-year drop is -14.3%, yet 32 of the last 43 years have seen positive returns for the S&P 500 (74% of the time). This helps remind us that there are always economic challenges, and the market has always dealt with them. It is my opinion that investors who have preserved and stuck to their investment process have been rewarded.

The markets, inflation data, and sometimes even our friends offer conflicting views of the economy, making it nearly impossible to make accurate short-term predictions on things like future rate hikes. Hence the tricky balancing act describing what an investor is to do.

This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. The information provided does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but there is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Any opinions are those of the author, and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Every investor's situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Investing involve risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Past performance may not be indicative of future results. The S&P 500 is an unmanaged index of 500 widely held stocks. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance.