The Basics of Social Security

Since 1935, Social Security has been one of the most important sources of income for retirees, however it is wrought with nuances that can leave even the most savvy person frustrated and confused. When the program accounts for the majority of income for most retirees, you’d be remiss if you didn’t do all it takes to ensure you’re maximizing your benefits. According to a Nationwide survey[1], those that work with a financial advisor report receiving Social Security benefits that are at least 20 percent higher than those who don’t. Therefore, be sure your first step in the process of claiming benefits is talking with your advisor.

There are a number of rules that dictate your claiming strategy and it is different for each individual so the process can seem time consuming and confusing. Through the planning process at Mainspring, advisors will discuss and help guide clients with the following:

- Claiming options and advice on the right strategy for the individual. The wrong decision has adverse impact like some benefits being lost forever

- Evaluating the impact of retirement timing on Social Security benefits and if it makes sense to work additional years or retire early

- Educating clients on how they can maximize Social Security benefits

- Helping clients understand how to fit Social Security into their retirement income planning

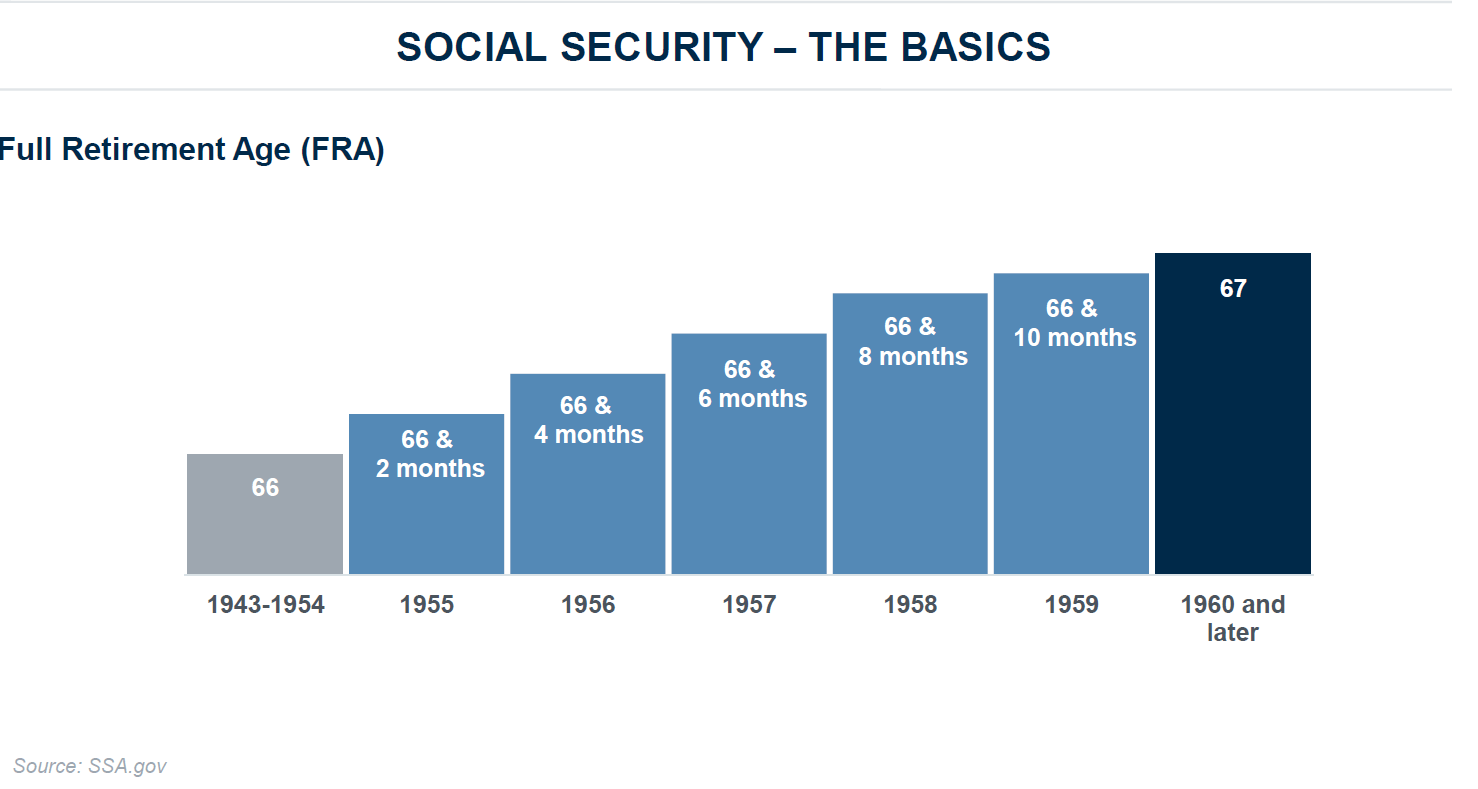

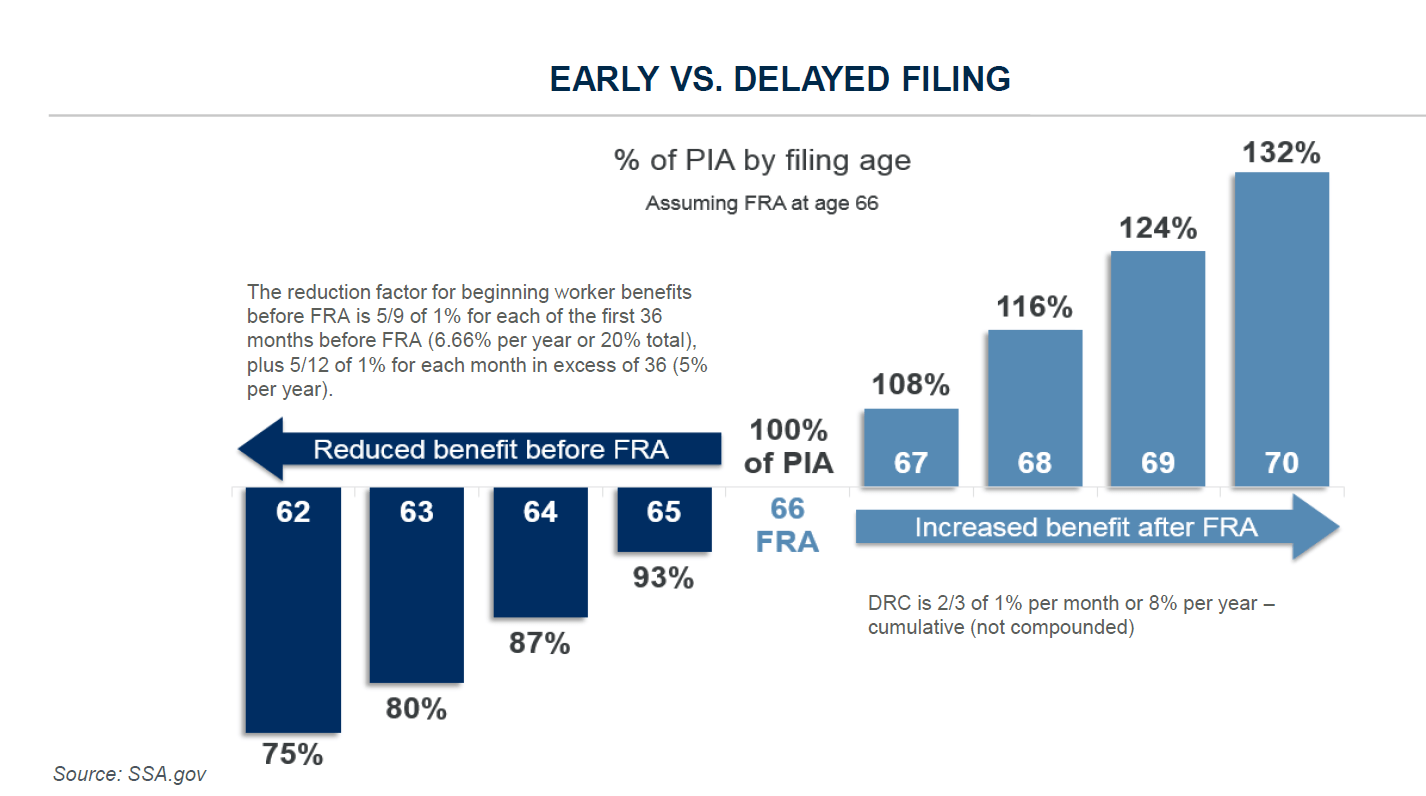

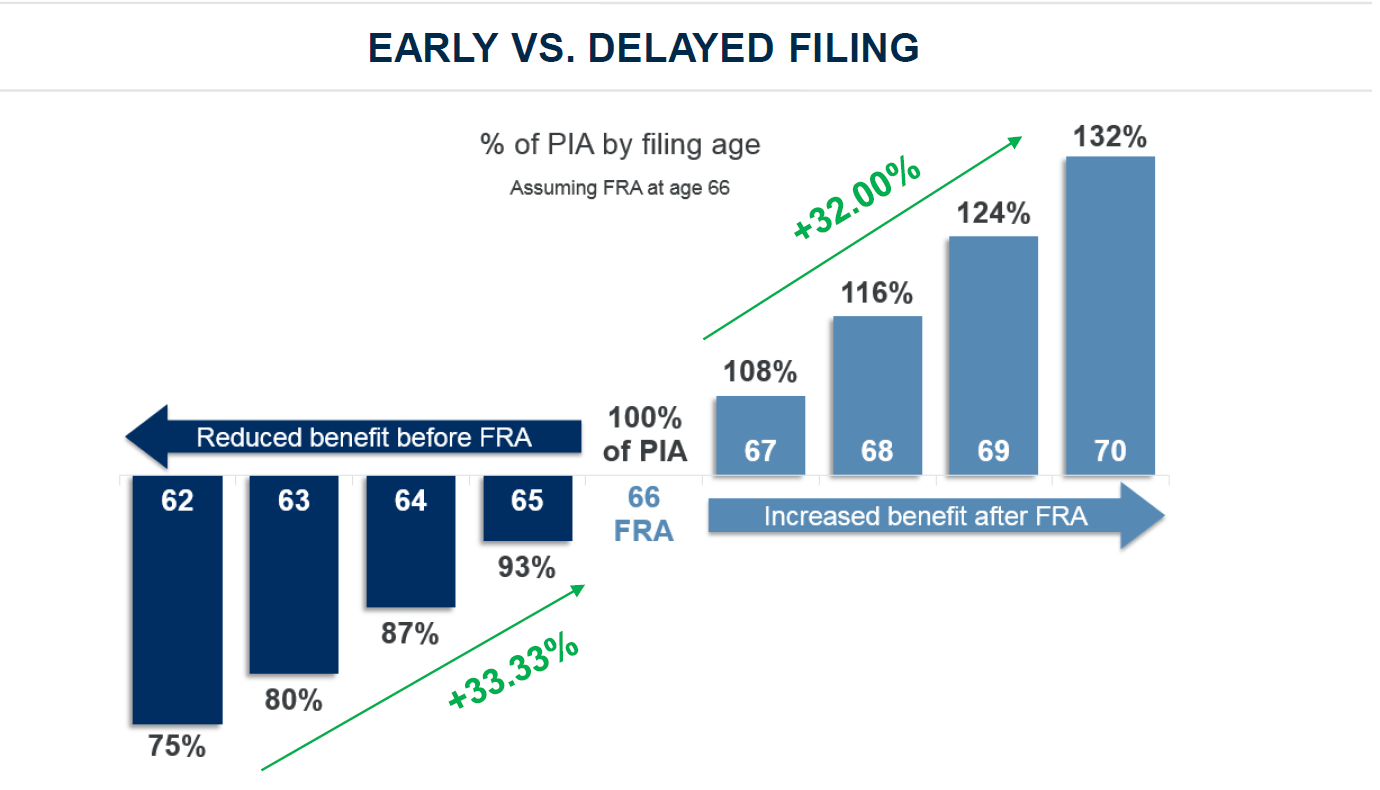

When determining the right strategy for each individual client, advisors will also look at specifics including health, other retirement income sources, your Full Retirement Age (FRA): the age at which you are eligible to retire which is based on your date of birth (Figure 1), and the impact of Early vs Delayed Filing (Figures 2 and 3). Each of these factors determines benefits and affects earnings.

For example, if you decide to begin claiming benefits at age 62 before reaching your designated Full Retirement Age, you run the risk of leaving money on the table because you’re locked in for a reduced income for your lifetime. However, if you defer your Social Security retirement income by either working or drawing on other income sources, you can maximize your benefits up to 132 percent. The latter is an attractive option for some because your guaranteed income growth rate is 8 percent per year which cannot be guaranteed on any other accounts. In a lot of cases, it can make sense to draw on other income sources or investment accounts and allow the Social Security benefit to grow 8 percent per year (or 2 percent every three months).

Figure 1

Figure 2

Figure 3

With each financial plan, it is our goal to help clients achieve financial independence in retirement so they are able to live the lives they’ve always dreamed. Social Security plays a large role in the planning process because of its specificity and how it can affect retirement income long term. Suffice it to say, it’s worth speaking with an advisor to determine how you can maximize your benefits in retirement.

Any opinions are those of Mainspring Wealth Advisors and not necessarily those of Raymond James. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Past performance does not guarantee future results. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.

[1] Nationwide Retirement Institute Social Security Consumer Survey